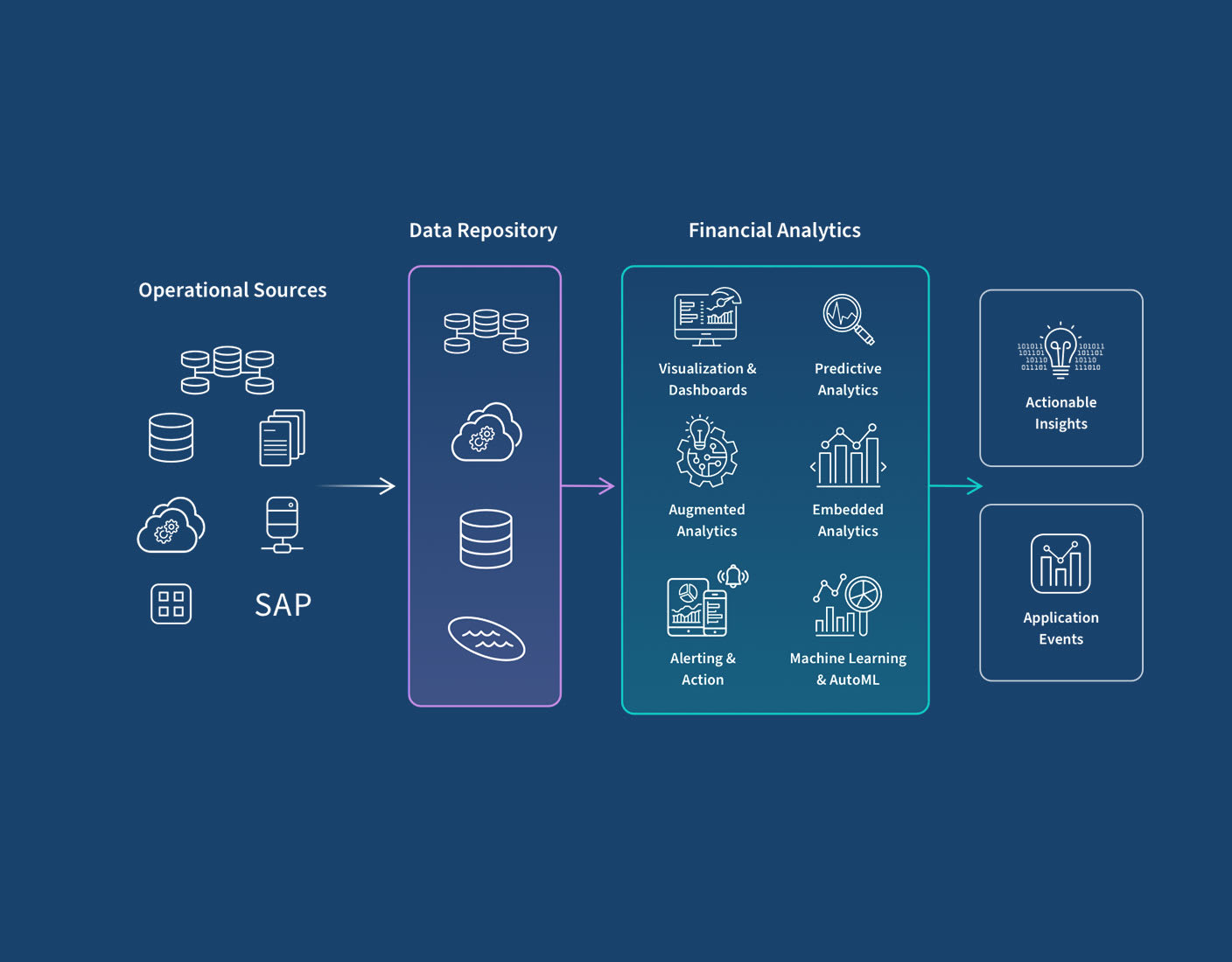

Why is it Important?

Modern financial analytics can be truly transformational–at both the departmental and organizational level. Your finance team will have more time to focus on deeper discovery and analysis. And new tools and techniques allow you to gain accurate and actionable insights that reduce costs and manage risks, improve profitability, and predict and plan for the future.

This helps transition the role of CFO from scorekeeper to being a key catalyst in wider business performance. Because ultimately, it helps you identify and assess your organization’s value drivers–the factors that increase the worth of your business.

Let’s dig deeper on how your finance operations become simpler, faster, and more informed:

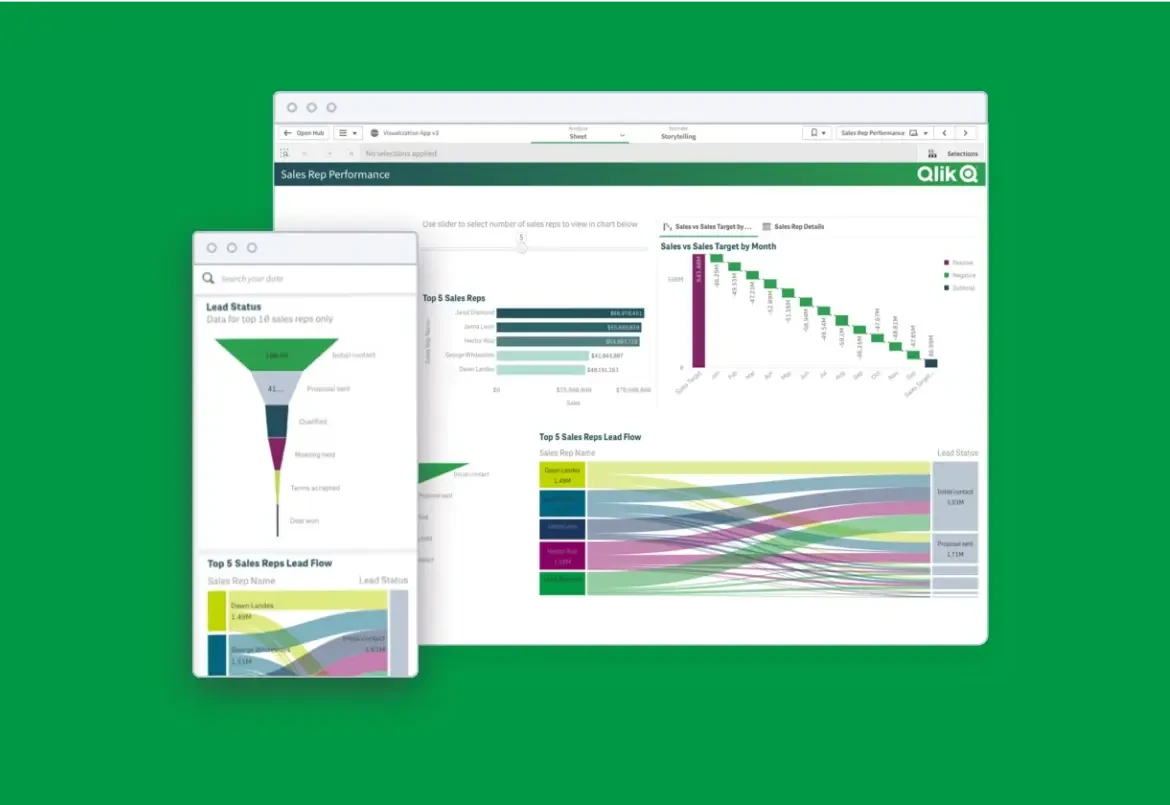

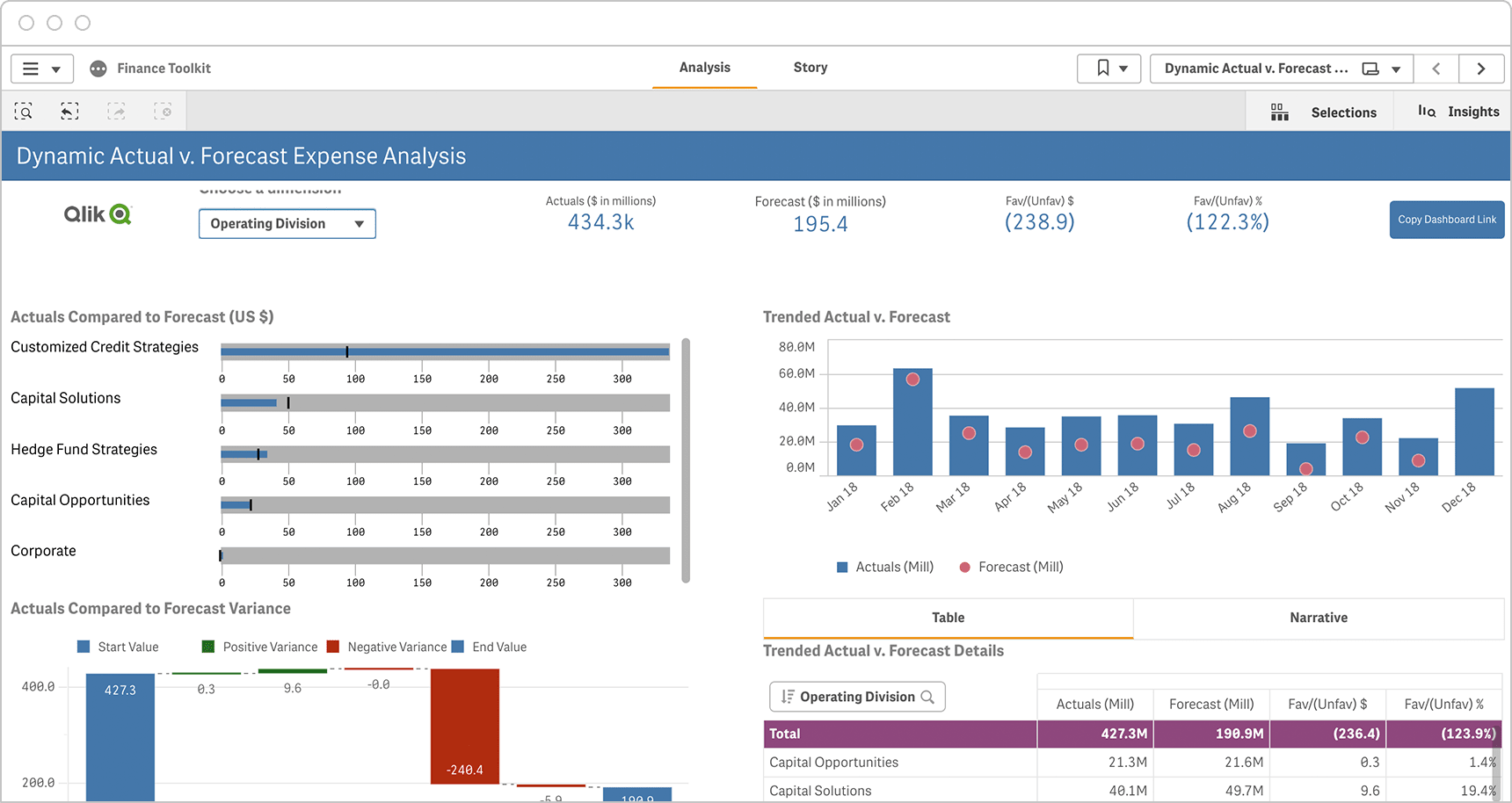

Your teams have complete and near real-time visibility of actuals vs budgeted performance.

Slow, static, and often inaccurate reporting is transformed into a slick, automated process.

Expenses and overspend becomes easy to manage. Concerns over duplicated vendor payments are eliminated as the data’s doing the work for you.

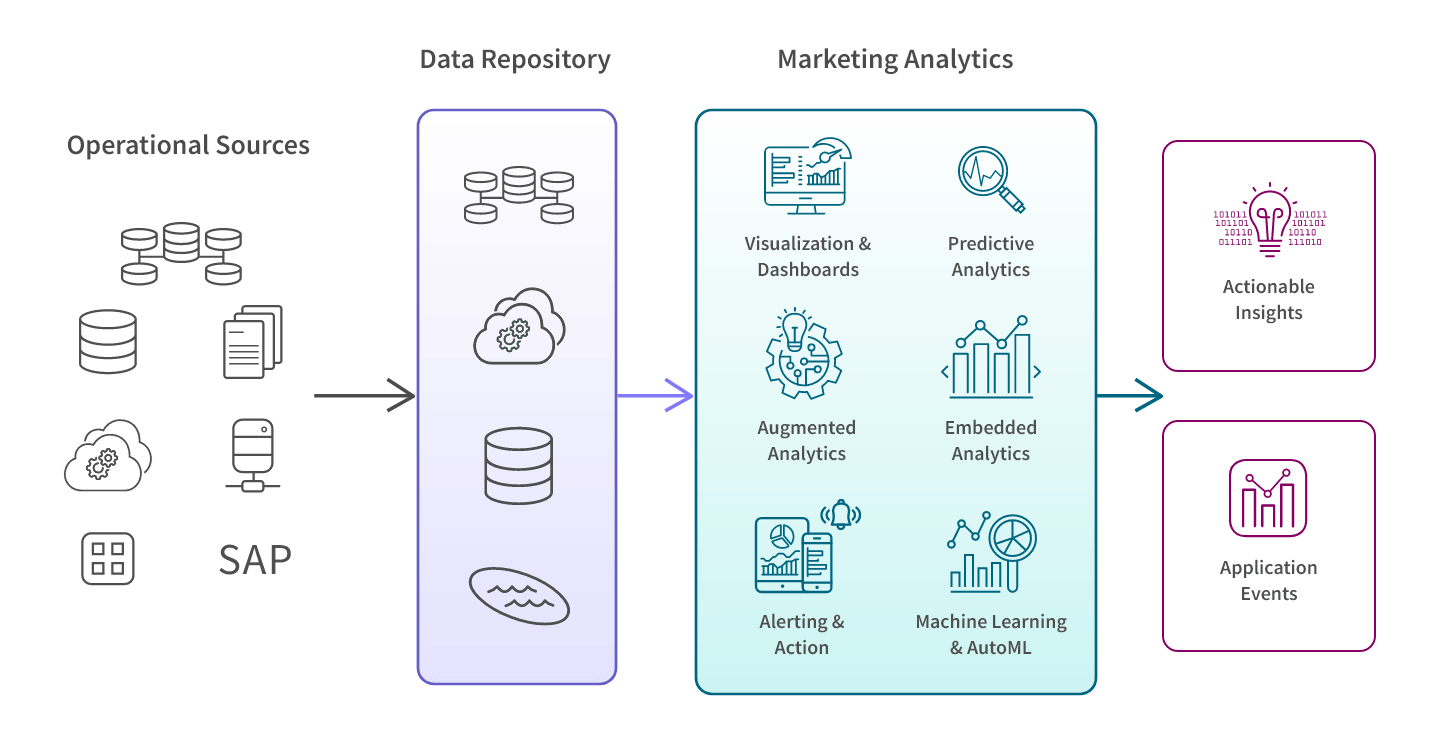

You don’t need to find the data you need across multiple silos because it’s already at your fingertips.

And you don’t need to pour over it to see what actions are required because you’re being alerted in real time when something needs to happen.

And the insights delivered by modern analytics can be extended to everyone – eliminating repetitive manual tasks.